Release Date: Sep 17,2022

Analysis of the growth comparison between 2020 and the first half of 2021 shows that the data will increase by nearly 30% year-on-year in the first half of 2021. This is in line with the average growth rate over the past 5 years. There is no sign of a slowdown in growth rates.

Operator capex fell by 3% in Q12021 - well below the 5-year average growth rate of 5%. A strong dollar was part of the decline. Seasonal fluctuations are another reason. We forecast capex to grow by 5% at the end of the year due to exciting developments in China, India and the US.

Operators' annual capex should approach or even exceed $200 billion in 2021. Sales of telecommunications equipment in 2021 were flat. Behind that number, at least from the point of view of the strengthening of the dollar, sales of Chinese OEMs rose and sales of European manufacturers fell. Most European suppliers saw their sales increase in euros, but decline in terms of dollar appreciation.

A 4% rise in datacom equipment sales in 2021 could at least temporarily reverse the declines of the past few quarters. Cisco also posted slightly higher profits in Q1 2021 and Q4 2020 compared to the same period last year. It is the only such mainstream manufacturer. Arista Networks and Mellanox had strong growth in Q1, solidifying their results in 2020.

Sales of optical device and module companies increased by 7.5% in 1H21. Report 2021 compared to Q4 2020 and year-over-year growth. Partly due to strong second-round demand for FTTx devices in early 2021. There was also an increase in its revenue, thanks to sales of 40GbE optics. Finisar's performance comes from the consistent performance of its rich product line. Second, in its accounting system, there is an extra week in the quarter. Hence the additional growth.

Other data collected shows that sales of optical transceivers in 2021 will exceed the entire optical device market. Sales of telecom transceivers increased 9% year-on-year in the first half of 2021, driven by strong demand for FTTx modules. Datacom transceiver sales rose 19 percent over the same period, benefiting from steady growth in 10GbE and 40GbE module sales. 100GbE transceivers are expected to ship in volume by the end of 2021, as many suppliers pass customer tests.

Total sales of optical transceivers in the first half of 2021 increased by 20% year-on-year -- far exceeding the sales growth rate of listed companies. This means that private companies are growing faster.

FTTx optical device revenue to exceed $1 billion in 2021

According to Ovum's latest forecast report, the FTTx optical device market will hit a new high in 2021, following record-breaking levels in 2014. The report predicts that FTTx optics will surpass the $1 billion mark in revenue this year after hitting a record $953 million in 2014. Ovum expects the market to remain strong next year, recording $985 million in revenue. The demand for PON equipment (OLT and ONT) is driving the optical components market to new record levels.

Julie Kunstler, principal analyst at Ovum and author of the report, said: "There are many positive factors driving the FTTx optical components market to a new peak, including the deployment of FTTH networks by China Mobile and the continued network buildout of China Telecom and China Unicom. Other positive factors Also includes FTTH networks all over the world; a frenzy of bandwidth marketing - many operators push higher and higher bandwidth products such as 1G/2G, and even 10G; and the use of FTTx PON to support non-residential markets and applications such as enterprise and MBH (Mobile Backhaul)."

Other positive trends leading to strong growth include the deployment of FTTx networks by several North American Multi-System Operators (MSOs), expansion plans for Google Fiber, deployment plans for U.S. telecom operators, European deployment plans, ongoing network deployments in the Middle East, SCA and Africa regions small deployments, and a move towards FTTP or FTTH (which requires more PON ONT optics) than FTTB.

Ovum's report highlights several key predictions:

Ovum's forecasts segment the market by OLT/ONT and BPON/EPON/GPON/next-generation PON (including 10G EPON, 10G GPON, and TWDM PON) standards.

Total shipments of OLT transceivers are expected to reach 6.5 million in 2021, a 19 percent increase from 2014.

In 2020, next-generation OLT transceiver shipments are expected to account for a 12% share of total OLT transceiver shipments, with 10G EPON OLTs dominating next-generation PONs.

Shipments of the entire ONT transceiver/BOSA market are expected to exceed 71 million in 2021, an 18% year-over-year increase over 2014.

In 2020, next-generation ONT transceiver/BOSA shipments are expected to account for more than 9% of the overall ONT transceiver/BOSA market, with 10G/1G EPON and 10G/10G EPON ONTs dominating the next-generation PON .

Ovum's PON optics forecast does not include any large FTTx deployments in densely populated countries such as India, Brazil and Indonesia. "Large deployments in these countries will lead to significant increases in shipments and revenue forecasts; so will the rapid deployment of next-generation PON, as the average selling price of next-generation PON optics is higher than non-next-generation prices," Kunstler said. "While 10G PON is slowly increasing, , but we are now seeing several U.S. cable operators and several Asia Pacific telcos deploying 10G PONs. Also, we are seeing lab trials involving TWDM PONs and even initial field deployments.”

In Ovum's forecast, the biggest potential downtrend could come from a slowdown in FTTx deployments by Chinese operators. China is the world's largest consumer of PON optical components, so any slowdown will have a negative impact on the forecast. However, we believe China Mobile, the newest entrant into the FTTx space, is well-positioned to deploy an FTTx network that will bring existing mobile subscribers to its new wired broadband network and provide additional services.

American optical module supplier launches CPRI protocol optical module for mobile fronthaul applications

American optical module and passive system supplier Champion ONE has launched a new module supporting the wireless common public radio interface CPRI protocol. CPRI is used for wireless base station to cell tower and related mobile fronthaul applications.

Champion ONE's new CPRI module includes SFP and SFP+ packages, supports dual-fiber, CWDM and DWDM applications, and also includes tunable wavelength modules, with transmission distances from 10 kilometers to 80 kilometers. Champion ONE and provide a 5 year warranty on all these modules.

With the increase in the deployment of distributed antennas in small cells, Champion ONE said that the demand for mobile fronthaul applications has increased rapidly recently. According to a LightCounting report, the market demand for optical modules for mobile fronthaul applications exceeds $500 million annually.

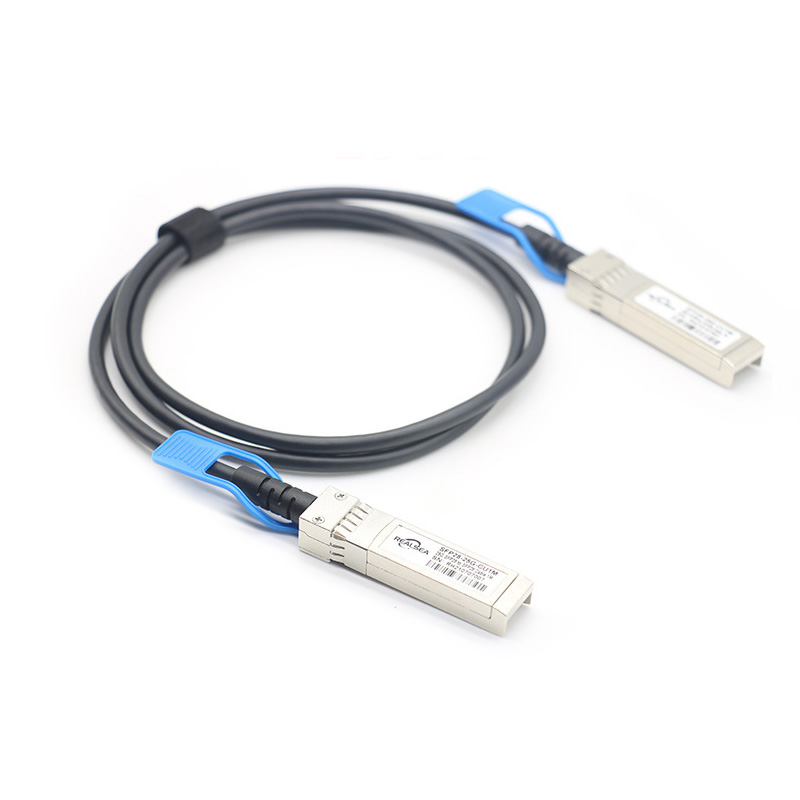

25G SFP28 DAC is a 25GBASE-CR direct attach copper cable for data center environment. It provides a high speed, cost-effective alternatives to fiber optics in 25GbE Ethernet applications.

fiber pigtail is typically a fiber optic cable with one end factory pre-terminated fiber connector and the other exposed fiber.

This Article just briefly overviews 10G and 25G Ethernet (25Gb) technologies, focusing on the SFP+ transceiver and SFP28 transceiver.